Micro-Finance, Macro Impact: Reflections from Phnom Penh

Words and pictures by Sejal Vallabh.

Sejal is currently a junior at Yale University where she majors in Economics and Mathematics. A Boston native and serial marathon runner, she spent this summer in Singapore interning at Skillseed and getting her hands on as many papayas and red bean buns she could find. Three weeks into her internship, we sent her on a recce trip to Phnom Penh, Cambodia - these are her thoughts.

NOWHERE WAS THE dichotomy more apparent than in that large boardroom in Phnom Penh City. Standing in one corner of the office, Reaksmey Thy and I awaited the arrival of Ban Phalleng, the Head of Social Performance Management at Thaneakea Phum Cambodia (TPC), the country's fifth largest microfinance institution. With nearly 190,000 active borrowers, TPC is a giant. Reaksmey walked over to one of the office's large windows, and pulling the curtains aside, he gaped at the expansive view of the city below.

Ban himself was impressive. Suit-wearing, business card-wielding—he seemed to be everything we were not. Compare that to Reaksmey's mud stained shoes, and my oily, bug spray covered skin; the contrast was almost laughable.

I'd spent the past couple of days with Reaksmey in Samrong-tong, a district an hour outside of Phnom Penh. Reaksmey is the director of Organisation for Building Community Resources (OBCR), a non-profit dedicated to microfinance, English-learning, and female empowerment in rural Cambodia. I was there on behalf of Skillseed, (where I'm an intern this summer), to gain a better understanding of OBCR's Fund for Entrepreneurs Business Initiative microfinance program (FEBi). My task is to develop a course that can both introduce student participants to the microfinance sector and help OBCR reach its long term goals. This trip was my recce.

Reaksmey Thy and I

On Monday, Reaksmey had taken me around Samrong-tong on his motorbike. From small coffee shops to barber parlors, I had the chance to visit a variety of FEBi micro-businesses. At each, I met with the entrepreneurs running the shops, learning more about FEBi's loan repayment, collateral, and saving policies. I sat in on a FEBi members' meeting, and met the entirety of the executive board. It was a unique experience to see the inner operations of a local savings group.

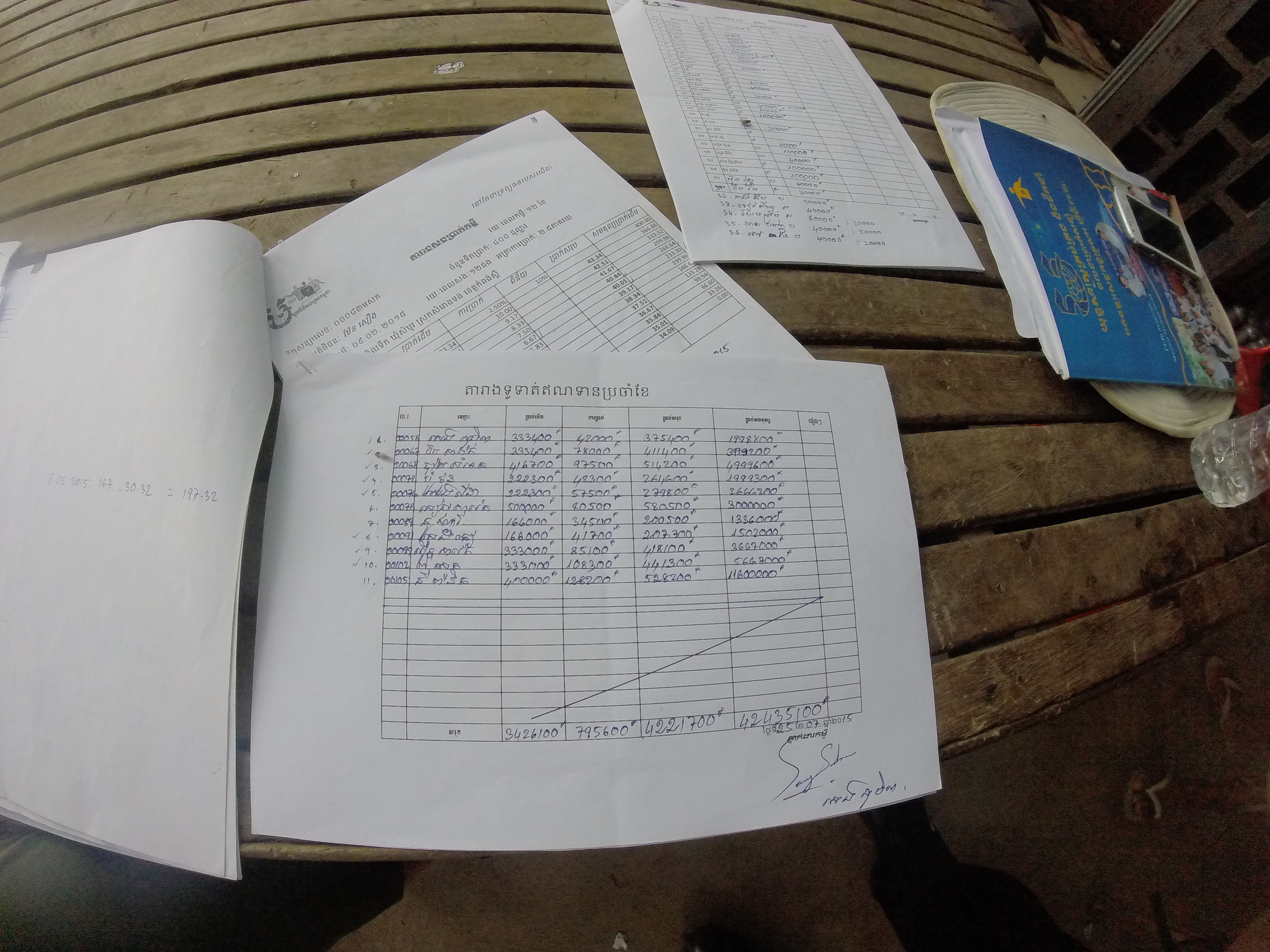

What impressed me most was the organic nature of FEBi. Completely volunteer-run, FEBi operates entirely off of village funding. Every month, members contribute $30,000 Riel ($7.50 USD) to a shared savings fund. An executive committee decides how to allocate the accumulated fund, creating seed grants for new entrepreneurs and microloans to strengthen existing businesses. Only about 25% of FEBi members actually request loans at any given time, but all continue to contribute so that others in the community can obtain the funding they need. The average turnaround for a FEBi loan is just one week, from application to issuance. FEBi boasts a loan default rate of practically 0%. When asked how the board ensures loans are repaid, Reaksmey simply replied, "we trust." If someone can't pay, their repayment schedule is extended until they can. And, in a community where everyone knows everyone, "saving face" becomes key. You have an incentive to repay; to default can cost you your respect.

Phnom Penh is a city littered with microfinance institutions. I often fear that social entrepreneurship has become too top-down in its approach, weighed down by fancy jargon. But at OBCR, the average turnaround for a loan is just one week, from application to issuance. Perhaps a few hundred dollars doesn't sound like much. But when that's enough to support a mother's tailoring business, those Benjamins go a long way.

Operating out of Reaksmey's backyard, OBCR also runs an English school. On Monday afternoon I attended a few classes. I planned to sit in the back and watch. But as soon as I walked in, I was introduced as "the new teacher", and the actual teacher took a seat. Talk she said, ask the students some questions. I was awkward, my speech was jumbled, and I didn't know what to say. I asked stupid questions like "What's your favorite fruit?". At a loss for words, I asked one little boy about the "I kiss only Red Sox fans" t-shirt he was wearing; he stared blankly back.

Nevertheless, I was praised. America was praised. My "pointed" nose was praised. The teacher wanted her daughter to be just like me, to go to an American university. Meanwhile her daughter snickered, and whispered something in Khmer. The mother turned around and translated for me, "oh, my daughter just said that I can't speak English properly." But without skipping a beat, she continued her praise. None of which I deserved. What had I done to earn her adulation? It came down to my American accent and the money in my wallet.

As a result I felt the constant need to distance myself from the United States. "I think the U.S. is boring, and I want to live in Asia anyway," I'd say. Or, "my family's actually from India, and Delhi has huge income inequality too."

The desire for everything American is tangible. Most blatantly, fear of the Cambodian Riel's instability has driven the country to adopt the US dollar as a main form of currency. On the last day of my trip, Reaksmey said he wanted to take me to one of the most famous sites in Phnom Penh. I thought he meant the Royal Palace, or perhaps the Tuol Sleng museum. Instead, I found myself at AEON, a mega mall. We wandered past a Gucci store, and a Porsche showroom, as he told me about the Rolls-Royce dealer in town. So he was surprised to hear that I actually really liked Nom Banh Chok (a Cambodian noodle soup) and that no, I didn't mind riding in a tuk tuk.

When Ban arrived, we sat down to brainstorm ways in which we could collaborate. It was interesting to see Ban and Reaksmey interact. Both were trying to achieve the same thing: to provide low-interest loans to rural Cambodian entrepreneurs. But their methods were entirely different. Ban's organization, TPC, is 97% foreign funded. He’s based in the center of Phnom Penh City. OBCR's office is Reaksmey's home, located in the village itself. And although each may have seen the other as competition, it was clear that the two could gain a lot from working together. TPC has money and credibility, OBCR has local influence but lacks international exposure. Ban helped develop a financial literacy radio program to advise Cambodian microcredit borrowers. We discussed the possibility of designing a financial literacy workshop for OBCR's entrepreneurs. The possibilities for collaboration are endless.

On my last night in Cambodia, Reaksmey and I spoke about the future. FEBi needs money to grow, he said. From what I had observed, FEBi's organic, community-based, unguarded (repayment is largely based on trust!) way of doing business is unique. Village members are willing to save their money with OBCR because they know intimately the people managing their funds. That's something large, foreign-owned microfinance institutions can't offer. But at the same time, the somewhat casual nature of FEBi is perhaps its largest impediment to growth. As of now, FEBi has no formal loan management system (all records are handwritten), no real process to screen loan applications, no website, no public promotion.

I know this isn’t the last I’ll see of Phnom Penh. Reaksmey recently asked me to act as a Savings Management Advisor to OBCR, helping them to apply for outside funding. I am excited to be a part of FEBi’s future.

And if all goes well, we hope to run our microfinance course (working title: “Microfinance, Macro Impact") within the next few months. Spending a “day in the life” of a FEBi micro-entrepreneur, student participants will learn what it takes to run a business in the developing world. Students will write up profiles on the entrepreneurs that they shadow, which OBCR can use to promote its social impact and showcase its borrowers. Lastly, students will design a financial literacy workshop for children living in Samrong-tong. Building off of the childhood game of “playing house,” the workshop will teach key skills such as saving, lending, and debt management as an interactive simulation.

So, a shameless plug: if you’re a student interested in exploring the field of microfinance, contact us to stay in the loop!